Fintech Software Development Company: Powering Your Startup

Last Updated on: April 13, 2023

The role of a fintech software development company has been at the forefront of the global financial sector.

As per a Market Data Forecast blog report, fintech will have an approximate global market size of $324 billion by 2026. This market size equals a compound annual growth rate of approximately 25.18% between 2022-2027.

Fintech software development companies have expertise in curating, building and deploying robust financial software to digitise & decentralise the financial architecture of different ventures.

A PR Newswire report states that the compound annual growth rate (CAGR) of 15.5% will drive the global digital payments market. It will reach $111.11 billion in 2023, a relative increase from $96.19 billion in 2022.

Have you ever wondered what fintech software companies do to power startups?

In this blog, we will discuss the dynamic role of fintech software development and how businesses leverage the benefits of fintech apps to regulate their financial operations.

This blog will shed light on the following aspects:

- Fintech Software Development: Use Cases

- Benefits Of A Fintech Software Development Company For Your Startup

- Various Fintech Software Development Company Services

- Fintech Software Innovations: Systango

Let’s dive into the nitty gritty of fintech software development companies now!

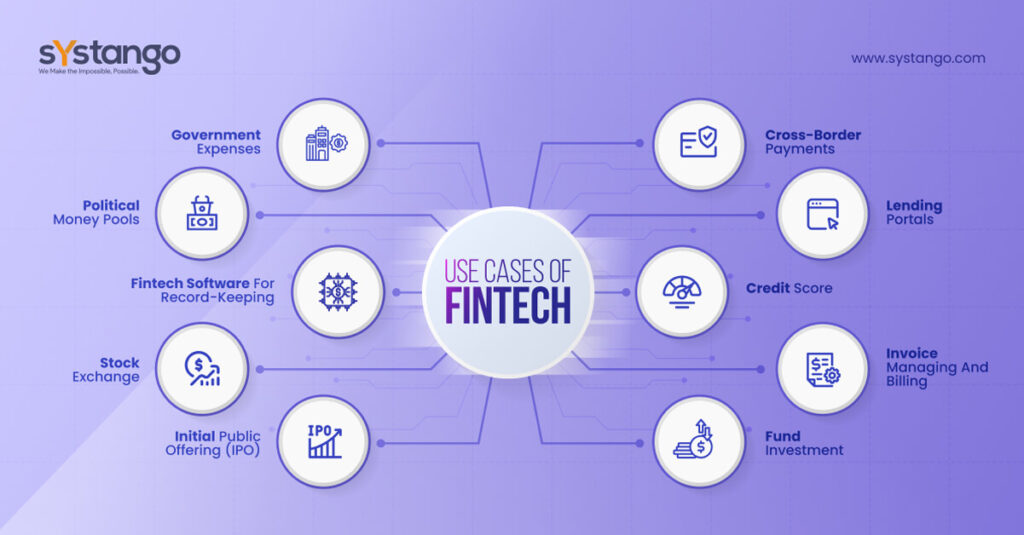

Fintech Software Development: Use Cases

Whether it’s a bank’s app or investing spare change with an online platform, all fintech companies use cutting-edge technologies like blockchain, artificial intelligence, machine learning, web3 and IoT.

Let’s look at the use cases of fintech to fully comprehend the future that a fintech software development company holds.

Some of the potential use cases of fintech are listed below:

Cross-border payments

A fintech company leverages Web3 technology to offer more affordable and robust payment solutions, particularly for cross-border transactions.

Fintech companies reduce costs associated with traditional payments and offer a faster settlement.

Lending portals

Since its invention, borrowers are leveraging fintech to deal directly with lenders for factors like rate of interest, timely instalments and transaction time.

Fintech software offers lending portal automation through smart contracts.

Credit score

Utilising fintech apps to manage credit scores implements transparency to the financial systems. Lenders can evaluate an individual’s creditworthiness by accessing his immutable blockchain transaction records.

Moreover, smart contracts guarantee that the applicant’s private information remains confidential and secure.

Invoice managing and billing

Fintech software helps organisations to adopt blockchain-based digital invoicing regulated with the help of smart contracts.

It helps companies upload invoices like payment due dates, amounts, and client information. When the client settles the invoice, the smart contract automatically updates the invoice status as “paid” and gives payment completion alerts to the companies.

Fund investment

Traditional fund investment is time taking and costly. It constitutes manual fund regulation via multiple databases.

Using fintech apps, investment providers can save users’ personal, legal and public information on a blockchain network. Fintech apps mitigate errors and frauds, increase transparency & give secure access to the data on-chain.

Government expenses

The government is leveraging fintech to store expense data related to city development, tax regulation for citizens and other such data. The immutable expense data record helps fight corruption in the centralised government processes.

Political money pools

Political parties can enhance transparency for voters by capturing information related to public funds received and disbursed on a blockchain.

Implementing fintech apps offers a decentralised and immutable record of transactions, ensuring the accuracy and integrity of the data.

Fintech software for record-keeping

Organisations leverage cutting-edge technologies like web3 and blockchain to store immutable financial history, Money on Money Multiple (MoM), profits earned & dividend distribution.

Fintech apps are based on smart contracts and allow the shareholders to access relevant information on their investments stored on-chain. This decentralised regulation accentuates transparency in record-keeping.

Stock exchange

A fintech software development company offers a decentralised approach to analysing and monitoring the stock exchange platform.

It eliminates the role of intermediary regulators as it relies on smart contract-based financial automation.

Initial Public Offering (IPO)

Investment processes are expensive due to the high fees of venture capitalists, banks & private investment firms.

By adopting fintech software, equity markets are stepping into decentralisation to cut down the cost of intermediaries.

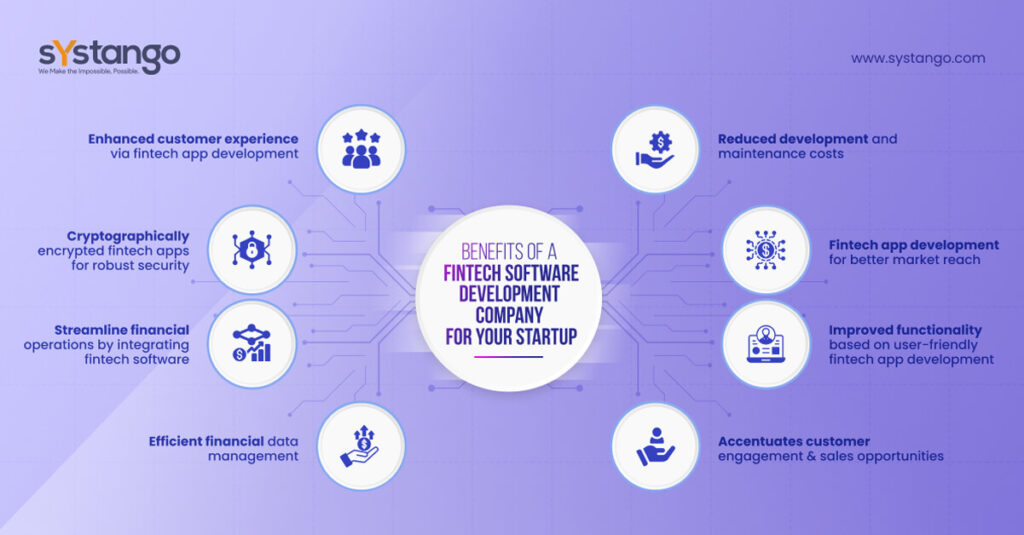

Benefits Of A Fintech Software Development Company For Your Startup

A fintech software development company powers you to offer your clients premium & extremely secure financial services. Here are a few reasons why you should opt for it:

- Reduced development and maintenance costs

- Fintech app development for better market reach

- Improved functionality based on user-friendly fintech app development

- Accentuates customer engagement & sales opportunities

- Enhanced customer experience via fintech app development

- Cryptographically encrypted fintech apps for robust security

- Streamline financial operations by integrating fintech software

- Efficient financial data management

Let’s now move ahead and check out the various services offered by a fintech software development company in the following section.

Various Fintech Software Development Company Services

A fintech software development company encompasses the following services:

- Fintech exchange development

- eWallet development

- Loan and tax calculators

- POS solution

- Payment gateway integration

- Credit processing solutions

- Custom financial reporting

- Onboarding & KYC (Know Your Customer) software

- Mobile payment solutions

- Online payment systems

- Wealth management software

- Financial analytics software

- Risk management software

- Fraud detection software

- Compliance management software

- AML (Anti-Money Laundering) software

- RegTech (Regulatory Technology) solutions

Fintech Software Innovations: Systango

Systango, as a fintech software development company assists organisations in rethinking their operations, simplifying processes, & bringing transparency to their system.

Our focus is security, quality, and customer experience while offering fintech software development services.

Our fintech software development experts have diverse experience in KYC, onboarding, credit checks, trade origination, settlement, payments, and risk management.

Some of our distinctive fintech software development innovations include:

- Standard Normal Energy (Energy trade tech platform)

- Sila (Instant settlement & wire transfer feature integration on digital payment platform)

- Future Bricks (P2P lending web app platform)

Looking for a fintech software development company to build robust & custom financial software for your organisation? connect with us now!